My husband and I made a New Year’s resolution about five years ago to get our finances in order… and we finally got around to it this year. Our main issue was that we have debt we want to pay off and there was always more months than money, so we never got any traction. I spent all of December reading blogs (including this Offbeat Home post), and financial guru guides, and sort of hobbled together a plan for us.

My husband and I made a New Year’s resolution about five years ago to get our finances in order… and we finally got around to it this year. Our main issue was that we have debt we want to pay off and there was always more months than money, so we never got any traction. I spent all of December reading blogs (including this Offbeat Home post), and financial guru guides, and sort of hobbled together a plan for us.

I started by actually tracking our spending. I just downloaded the transaction history for a month from our bank account (you could also keep a journal of your spending too). I dumped it all into a Google Drive Spreadsheet and then I categorized each transaction: food, gas, car payment, mortgage, restaurants, black tar heroin — you get the idea.

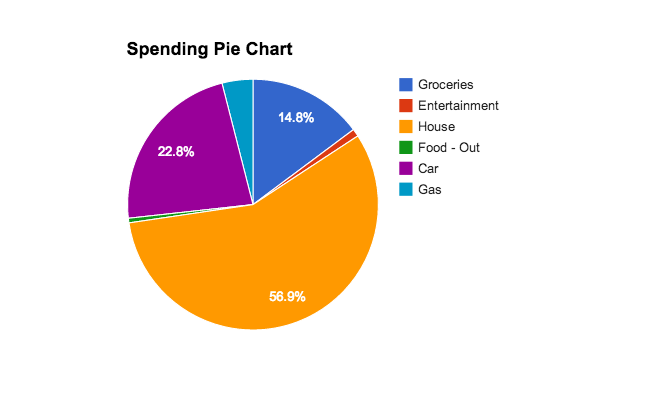

Then I sorted by category, and added each thing up to see how much we actually spent on each category a month (you can make a little pie chart too, if you’re into that kind of thing).

We were gobsmacked by a few things. Our most surprising was that we spend over $300 a month on tolls. We never really noticed because the payment auto-drafted. There were a few more places that we felt like we could do better, so we decided to make a budget.

Until this point, our budget was paying our bills and then seeing what was leftover and adjust our spending accordingly. Sometimes we’d stay under budget, most times we’d go a bit over. There was never really a plan.

After all the Googling and reading the budget, the process that clicked for us was the Zero Based Budget (full disclosure this is the budget that Dave Ramsey recommends.) The way it works is this…

Choosing a charity to support this December

Choosing a charity to support this December

Every year our family chooses a charity to donate to instead of giving each other more "stuff." This year it is my turn to choose,... Read more

Make a spreadsheet

You could do it by hand too. Start with your total income for the month at the top and then down the side you make a list of all of your expenses — preferably by priority or importance. (On the sample spreadsheet, the budget is on the second worksheet called “Budget.”)

On the example sheet you’d put your total take-home pay for the month or pay period in the green box. Next to each category you put the realistic amount you expect to spend (realistic is key) in the Monthly Budget column and you’ll get a running total of how much money you have left in the next column.

Spend your money in the budget first and make a plan for each dollar

This helped me to keep myself accountable, because in my mind I had already spent all of my money. I also added the last column on that sheet that tells you what percentage of your money you’re spending on each category (14.5% on Black Tar Heroin — I should probably see someone about that). I’ve got 40 cents left!

The last step of the budget is the most important

You’ve got to stick to it. If you said $200 on Food, you can’t spend more — because even though the money is in the account, you have it earmarked for something else.

If you have a partner you share finances with you NEED to do it together

Especially if one partner does the grocery shopping and another does the budget — you’ll have no idea what’s a reasonable amount to spend. From a relationship standpoint it’s good to have everyone involved (money fights are awful). If everyone knows what’s going on the communication about money is so much easier.

It gets easier

Your first budget will probably take you a while to put together. But since most things are fixed, or in the same range every month, it gets easier and easier as the months go on.

When the Hubbo and I finally got into budgeting ourselves it felt like we had gotten a raise and it assuaged some of the guilt that we both used to feel about personal spending (getting my eyebrows waxed, buying black tar heroin or video games). When we want to save for something bigger like a vacation or a new video game console we add a line to the budget for that savings account and allot the money each month until we can afford it (this curbs a lot of impulse spending we might have done on credit cards in the past).

I have found mint.com to be exceedingly helpful. My husband and I share a Mint account (since we have separate bank accounts) so all of our loans, bills, and accounts are in one place. The coolest thing about it, other than the fact that it’s automated and all of your transactions are right there, is that it’ll tell you over time what your average spending amounts are. It really comes in handy when you need to alter your spending for any reason. You can see what is and isn’t realistic toward your goals.

Yep, I’ve been using Mint.com since I was in college. The automation makes it so easy for me to keep up with.

I’ve been hesitant to sign up with mint since you have to give them login information for your bank accounts. Do you have any qualms or issues with that, or have you felt fairly safe with them having that information?

Using a budget like this is seriously liberating. I don’t remember if we can reference online resources, but the thing that makes my husband and I love our budgeting selves is a website named after a lovely herb that you use to make Mojitos. We combined all our accounts in the website (we still keep separate account and have one joint account for big automatic stuff like mortgage payments, utilities, groceries). The site will allow you to set up budgets, look at spending trends, tag things and even split purchases to allocate them under different spending areas (so your Costco groceries can be separated from your winter tires or underwear). Takes a bit of effort to set up but then we sit down every quarter (we try monthly and we just never get to it), and make sure things are tagged right, and discuss where we are up and where we have to cut back or adjust. Do it!

I started doing something pretty similar to this when I started getting my disability payments. Nothing like having not a lot of money to make you want to budget correctly! It works great.

We use software called YNAB. It’s perfect for the kind of zero based budget Talked about here.

I use YNAB too! It has seriously changed my life. I LOVE IT.

We never used to be able to save any money… I would always wait to the end of the month to transfer ‘what’s left’, and there never was anything left.

My net worth has SKYROCKETED since using YNAB (You Need A Budget). They do a free 30 day trial, and I’d really recommend you watch the training videos to see the YNAB method in action.

YNAB changed my life (and my marriage). The first two months of using it we fought more about money than we had in 5 years of marriage. Then we stopped fighting and have never fought about money since. It definitely has a bit of a learning curve if you’ve never done that kind of budgeting before but it’s so so worth it. Really makes you figure out what your financial priorities really are. The thing I really like about YNAB is that it’s super flexible while still making it obvious that you don’t have unlimited amounts of money just hangin’ out there in your bank account. We’ll frequently go over budget in one area, and take money out of another area to cover it. Spending more on food this month means we have less to spend on household. If we go over budget for travel that means no new shoes til next month. It’s super transparent without being rigid, which I really appreciate.

It’s amazing what hits you when you actually look at your budget, isn’t it? My husband and I go in spurts of being really good at tracking our money, and quite bad. At one point, we wondered “Where’s it all going?” and put together a spreadsheet and DAMN, we had spent $250 on eating out in like a 2 week period! It didn’t SEEM like it at the time, because we didn’t go out for a 200 dollar meal. But a Jimmy Johns run here, buying bagels for the office there, pizza with friends one night and sushi another… It added up. Now we’ve set a limit of $50 a week – whether that’s one nice dinner out or several fast food runs, that’s it.

The problem I have with strict budgeting is that there is always something that comes up. Last month, it was an unexpected car repair and upping my car registration. This month, auto insurance is due. But we might go 5 months without car stuff, so we can’t just make “car” a category. Next month it might be medical bills or something else. And we don’t want to just put more into savings, because we like to set a certain amount for savings and then NO TOUCH. So our budget would be, like, 20% house, 5% car payment, 50% student loans, 5% food, 20% WHO THE HELL KNOWS BUT SOMETHING.

Honestly, the best thing for us is automatic saving. We get X amount pulled into savings immediately, from each paycheck. And as I said above, NO TOUCH. If our savings goes above a certain threshold, then we’ll pull it out for a specific purpose (paying down debt, installing a fence) but it doesn’t go towards every day stuff. If I did it any other way, I know I would not save as much.

Actually, since my husband and I use the mvelopes.com budget we do put some aside each month for stuff that comes up sporadically. e.g. we put $50 a month into the “dog” mvelope even though we don’t spend that much at once, but then when it is time to take him to the vet we’ve got a little pile of money there for the bill. Or, with car stuff we can put a little bit of money each month into the “repair” fund so when something blows up we don’t take the hit totally out of one month’s budget. (although we’ve had one or two major blow ups that meant using the emergency fund for the emergency that just happened!)

It takes a while to be able to smooth out the cash flow to be able to set aside little bits each month for those periodic expenses, but we worked towards it and are much more relaxed about it now.

The YNAB software has this covered – seriously. Firstly, you save money for ‘rainy days’ like car breakdowns etc. Secondly, one of their rules is ‘Roll with the punches’. You make your best guess at what you think you will spend, but you move money around as necessary and you don’t feel guilty about it.

We separate out part of our savings into an emergency fund that we use for unexpected expenses like an expensive vet bill or a car repair. Its really helped us stop using credit cards as an emergency fund or ending up eat top ramen for a month because the tire blew out.

We’ve got an emergency fund, but I’m talking more about stuff that’s not quite an emergency. Car registration, new pair of pants, piece of furniture, dog vet bills…. just every month there’s some random shit that pops up that is irregular so it’s hard to plan for.

That kind of stuff is irregular, but it’s also predictable. You can predict that you’ll probably need to spend X amount on new clothes per year, even if you don’t know what month you’ll need to spend it. If you put aside a little bit each month, the money will be there when you need it and it won’t affect the rest of your budget.

Honestly it also helps me to have categories for those things because sometimes I DON’T actually need whatever it is right then. If I want a $50 pair of pants but there’s only $40 in the clothes fund, I can wait til next month to get them. If I notice our couch is getting pretty worn, I can plan to put aside enough each month to have enough in 6 months to get a new one. Obviously that doesn’t work for true emergencies like vet bills, but even those you can make an educated guess about how much you’ll need over the next year or so.

I don’t know, but I think you could have a car category. You know that you’ll have auto insurance every 6 months or once a year. And you know that you’ll have some car repairs and other related things. So at a minimum, you could divide the car insurance by 12 and start putting the money aside every month. And maybe add $5-10 for increases or a small head start on other car related expenses?

On Mint you can set some items up as “monthly” and others to “Roll-over” – so we set the car expenses as an annual expense, knowing it might not be something that hits until October, but then you know you put money against it every month. It has required a behavior change for me, because I like seeing things go out of the account, and when I get to zero dollars, no more spending! But instead, I’ve had to get used to a running balance, which should increase over the course of the year, because it’s earmarked for a bunch of stuff. Other good annual expenses to roll-over are vacations. You can blow it all at once, but then you’ll see a red line until you’ve paid it off over the months to follow.

I used the old school (ala Dave Ramsey) envelopes filled with cash budget method for groceries when I first got out of grad school. I had the bad habit of going to the grocery store and buying a bunch of stuff, but still always missing a few things to make make real meals. Then, I started putting my money into 30 (or 31) different envelopes for the month. If I took three days worth of food money to the store I had to come home with three days worth of food. It was such a thrill to have money left over so I could splurge on stuff at the end of the month!

Once I got the hang of that I went back to debit cards and digital tracking using an online version of that called mvelopes – http://www.mvelopes.com

We do our budget at the beginning of the month and then “fund” certain envelopes. Awesome when we’re saving for something or earmarking money. (e.g. sold a couch on craiglist before our money, noted that income and marked it “new couch” for when we settle into our new place).

Does mvelopes.com link to your bank account? I have tried mint and one other site/app thingy (the name escapes me) but since we use a small credit union they all are like “oh that bank doesn’t exist” and are pretty much useless….

I run into the same problems with using a small credit union – none of the apps work for me.

mvelopes.com just told me that my email isn’t valid. Can’t get a win here!

Oh, no! That’s crummy it doesn’t like you’re email! 🙁

Yes, mvelopes links to all of my accounts (bank, credit union, mortgage, student loan) – hmm…they had both of the credit unions I’ve used.

I think I’ve mentioned it before somewhere on this site, but Goodbudget.com is my go-to (free) budget tool. Envelope budgeting is the way to go! What helps is having an envelope specifically dedicated to Savings…the money in that envelope goes straight in the bank. That way, you build yourself a cushion (for retirement, for a rainy-day fund, for bigger purchases like cars and houses, etc.), and you still have your other dedicated envelopes for day-to-day purchases.

My husband and I are actually about a month away from closing on our first house (Woo-hoo! Terrifying!), and we’re going to be extra diligent about budgeting now that we’ll have a mortgage to pay.

Does anyone have advice on how to create a budget on a variable income? My husband is a civil process server (He serves court documents) and he gets payed per paper he delivers. As this depends largely on whether or not people answer their door and admit to who they are instead of lying to him…his paycheck is never the same week to week. My parents taught me the importance of creating a budget and how to do so on a steady income, but I have no idea how to do it on a variable income. Help please!

My favourite financial advice person is Gail Vaz Oxlade – she’s really a no-bullcrap person and she has a book called “Money Rules” – granted it has some Canadian content but you can browse her blog too for some great ideas. She talks in that book about having Budgets A, B, and C for variable income people. I also found this blog post on variable incomes: http://gailvazoxlade.com/blog/?p=97

Thank you! I will check it out.

For variable income (which is all we’ve ever had) you can either try making a “strict” budget, for your lowest income you can foresee getting (then on better months put the extras in savings with a little for fun stuff) or you can average by the last year’s income and make sure you always leave a “cushion” of about half a month’s expenses in the checking you use, in case you have a bad month. You can still do Zero Budgeting even, just your personal “zero” will not actually be literal zero.

The strict version will end up with you saving more money, but also having less fun probably. It depends on if you think you can handle that, and obviously if you ever have absurdly low months you simply can’t survive on then the averaging method is better suited.

Thanks for the tip!

I don’t have a variable income, but have coached a lot of folks who do when I’ve taught dave ramsey’s financial peace university. The two tips I’ve shared with others who have variable income are:

1. make a prioritized spending list and just start at the top and go down as far as you can. Some things in a short month are “below the line” and just don’t get funded. (I know some folks who were super far behind on their bills and this method helped them feel more relaxed because they intentionally chose what was most important to pay and felt good about the choice they made in their tough situation. Before they did that they always felt at the mercy of the collectors who called and were stressed because they were always being pressed for a payment. Now they just tell them “not this month” and hang up.)

2. Make a “hill and valley” account. Figure out what you need to live on in a month and set your baseline budget there. In a month that you bring in more than that you’re up so you just stick the extra into the hill and valley account. The next month when you don’t make as much and you’re down in the valley you pull out what you need to smooth out the month’s budget.

The second tip takes a little while to implement as you figure out what a “normal” month should look like for you. If you like forms there are helpful ones on the Ramsey website. Just search for his name and variable income budget and it will come right up.

My husband and I have always been extremely thrifty with our finances, until a few years ago. He landed a much better job that did several things that were awesome, but suddenly our bank account was hurting. He had more free time and enjoyed who he worked with so much that he would go to lunch then happy hour then maybe dinner. It was so often that we decided he needed a “fun” budget- I mean he had a huge pay rise so why not have fun? Except he could never keep track of it. Receipts piled up and the budget was always over. Then we did a cash budget and now he always has money left over. Every time. I highly recommend cash envelopes for anyone having issues sticking to a budget plan.

Also, it is very enjoyable seeing a jar of money grow from his leftover budget cash.

Despite theoretically having a national median household income, my husband and I are desperately trying to figure out our financial situation, because it’s just not enough despite our pretty meager lifestyle. The book I can recommend most highly is Your Money or Your Life, which deals with making your money fit your life rather than the other way around. It’s dense, but the 9-step plan they outline really makes a lot of sense to a lot of people.

Inspired by this post I spent the evening setting up a Mint account. I can see it is not laid out in a way that works with my brain intuitively and I find it to be a pain to navigate. I’m going to try a few of the free versions of envelope systems and see how that goes. I have a feeling I’m still going to end up with some sort of spreadsheet, too. Man, being the financially responsible one is a drag but I have to do something because the money stress is detrimental to my mental health and relationship!

We do something like the zero budget, but I guess I’m old school…we do it on paper!

My husband and I both get paid every two weeks, and on that day we sit down and write how much the check was…go through the bills we need to pay out of that check, and then talk about groceries, events coming up during the next 2 weeks, or things we want/need to buy. Then we subtract and see what’s left. With THAT, we’ll pay extra on debt, put it in savings, or decide to get something we’ve been talking about buying, but haven’t got around to it yet. This month it was P90X 3. This method has seemed to work for us…and I feel super anxious on payday until we do our budget!

So basically the same thing, I guess I’m weird in that I prefer to do it on paper and not on a website. Not sure why.

We do it on Excel. It keeps it off the internet and avoids us having to pay someone to keep track, but it’s handy to have a tool that automatically adds, subtracts, does percentages, etc. I like that we can check off each monthly payment as we make it as both a visual reminder and a pleasing feeling of watching the number we owe go down to zero. It also gives instant feedback–if we put in a number and suddenly the totals are way off from normal, we can check on that immediately.

Yay! An author who uses the dave ramsey method! I took the classes and still have all the spreadsheets and plans. I absolutely love his views on budgeting, its very simple and direct, and has a lot to do with the willpower you have to have to put it all into practice. After taking that class, I actually learned a LOT about stuff no one ever cared to explain like the types of insurances out there and why some are needed and some arent depending on your lifestyle. It even told me more about buying homes or renting. If you like him and his daughter’s facebook, they give you tips everyday on how to stay on track with everything. =) Still working on the debt snowball right now.